Reverse Mortgages with Richard Brown – 04.01.2024

This episode of About the House is brought to you by the Construction Consumer Advocacy Institute https://constructionconsumeradvocacyinstitute.com/

In this episode of About the House with Troy Galloway, Troy talks to Richard Brown about Reverse Mortgages a.k.a. HECMs. Find out how you can use your home’s value to pay for medical expenses and in-home healthcare.

Contact Richard “Rick” Brown, Reverse Mortgage Loan Officer NMLS #247348

C : (314) 249-3418

F : (314) 334-2919

rbrown@university-bank.com

https://www.university-bank.com/reverse/about-reverse/rick-brown/

DISCLOSURE: University Bank – Reverse Mortgage Division, Equal Housing Opportunity – NMLS 715685, 2015 Washtenaw Ave, Ann Arbor, MI 48104 – (www.nmlsconsumeraccess.org), Member FDIC that operates in various states. For a complete list of the states University Bank can operate in please visit https://www.university-bank.com/licensing. This is not a commitment to lend or an offer for a rate lock agreement. All Mortgage transactions are subject to verification of application information, satisfying all underwriting conditions and requirements. Restrictions apply.

WHAT’S INSIDE

3:00 How long has Rick been doing Reverse Mortgages A.K.A. HECMs?

4:47 How does Rick explain Reverse Mortgages to new clients?

6:35 Rick has to read a disclosure. The numbers presented today are examples and do not reflect what your numbers will be.

34:26 Rick begins his slideshow presentation

34:30 Introduction to Reverse Mortgages A.K.A. Home Equity Conversion Mortgage (H.E.C.M.)

34:39 What is the definition of a Reverse Mortgage or H.E.C.M.?

36:20 What are some issues to think about when considering a Reverse Mortgage?

39:30 Adjustable and fixed-rate Reverse Mortgages

39:43 A brief overview of Reverse Mortgages

42:23 The mechanics of a Reverse Mortgage

45:13 An example of a HECM with a $300,000 home

50:05 What happens if the home value does not appreciate after a Reverse Mortgage is put in place?

50:59 A chart showing the home appreciation rate being less than expected

53:03 What if there is an average 3% increase in interest rate?

55:03 How/why might a senior borrower use line of credit funds in the future

55:18 Potential future uses of growing line of credit

58:15 Delaying commencement of social security

58:56 One spouse dies

1:00:14 Directing all proceeds to a guaranteed monthly payment

1:03:57 What are ill-suited quarters?

1:05:51 HECM for purchase

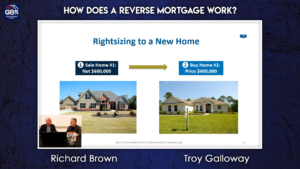

1:06:43 Rightsizing to a new home

1:07:14 Impact on retirement success likelihood

1:08:55 Sampling of potential HECM users

1:09:23 Why not wait to get a HECM until I know I need it

1:10:36 Reasons to get a Reverse Mortgage today rather than later

1:11:58 Reverse Mortage VS a home equity line of credit

1:12:30 FHA HECM guarantees

1:13:00 How does the FHA prevent insolvency?

1:13:43 Qualifying requirements for a HECM

1:14:19 What seniors are good candidates for a Reverse Mortgage?

1:14:45 What do financial planning gurus think of HECMs?

1:15:00 HECMs and the financial planning profession

1:16:03 What is the FHA’s 60% year 1 proceeds limitation rule?

1:17:26 How do adjustable rate mortgages work?

1:18:12 What is the story with non-borrowing spouses?

1:19:26 How do Reverse Mortgages work in a Grey Divorce Settlement?

1:19:41 Adjustable and fixed-rate HECMs

1:20:20 Expanded HECM overview

1:20:26 More questions? Contact Rick at rbrown@university-bank.com